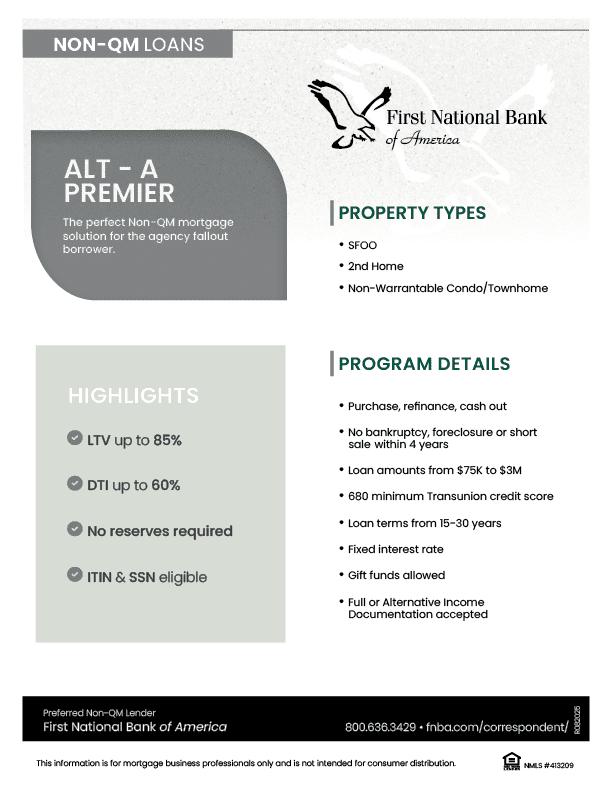

Non-QM Loan Programs

Your Experienced Non-QM Correspondent Lending Partner

With more than 70 years of residential lending experience, FNBA is a trusted Non-QM lender for correspondent partners nationwide. We specialize in delivering alternative mortgage programs that help you serve creditworthy borrowers who fall outside of traditional guidelines.

Our Non-QM Loan programs are designed to simplify the process for you and your borrowers.

Whether your borrower is purchasing a single-family home, second home, investment property, non-warrantable condo, mobile home on land or vacant land, FNBA has the solutions to help you make it happen. As your correspondent lending partner, we make Non-QM simple.